Inflation, a hot topic at the moment and we are feeling it in every aspect of our lives, whether its putting gas in our cars, buying groceries, or purchasing new goods and services. Inflation is everywhere. But what is inflation and what impact is this having on out interest rates when we go to refix our loans or take up a new home loan? This is what I will attempt to answer with this blog.

What is Inflation?

Not wanting to bore people with the dictionary definition of Inflation, I want to explain this in simple terms. Inflation is effectively the increase of cost based on the supply and demand of a product or service. Inflation comes in many forms, there is endless examples of products and services experiencing inflation pressures however let’s use the following example.

Say I am a bed manufacturer in another country, Covid lockdowns meant I had to close down my factory for 6 months. In NZ let’s say there is 10,000 people per year purchasing beds. However, the manufacturer only managed to produce 7,500 beds last year. The manufacturer still has the same costs, staff, utilities, regulations etc etc. Their costs haven’t changed or have in fact been increasing b

purchasing beds. However, the manufacturer only managed to produce 7,500 beds last year. The manufacturer still has the same costs, staff, utilities, regulations etc etc. Their costs haven’t changed or have in fact been increasing b

ecause freight costs have gone up. So how does the manufacturer cover their costs? Well instead of your new bed costing $1,000, its now going to cost you $1,500,

because demand for new beds hasn’t slowed and we now pay more. That in essence is how inflation affects us.

We see this closer to home, environmental effects and staff shortages has affected our food production industry, Recently I saw a story about a produce producer who effectively had to let his crop of cauliflower go to waste because he didn’t have enough staff to harvest his crop. This means we have less cauliflower going to the supermarkets and this is why we are now paying $5+ for cauliflower.

Inflation as of last quarter was 7.3% which is the highest it has been since the early 1990’s, we haven’t seen inflation this high in a generation and for younger New Zealanders we’ve never experienced cost increases this rapidly in our adult lives.

Source: RBNZ

Inflation vs Interest rates.

Inflation in New Zealand is managed by the Reserve Bank. The Reserve banks main mandate is to keep inflation within 1-3% and it will adjust the official cash rate (OCR) to help raise or lower the rate of inflation. But what does this mean? It means when we have high inflation the Reserve Bank has no choice but to raise the rates which affects everyone with a home loan and most people renting a property in NZ.  Roughly 2 out of 3 New Zealanders own a home and the majority of people renting in NZ are renting from “mum & dad” investors who own 1 or 2 rentals. For those investors they have normally borrowed money from the bank and are also affected by rising interest rates. If their costs increase, they again may pass those costs onto their tenants in the way of rent increases.

Roughly 2 out of 3 New Zealanders own a home and the majority of people renting in NZ are renting from “mum & dad” investors who own 1 or 2 rentals. For those investors they have normally borrowed money from the bank and are also affected by rising interest rates. If their costs increase, they again may pass those costs onto their tenants in the way of rent increases.

So, say for example, last year I was on a rate of 2.49% and now my rate has increased to 4.65% this means my mortgage payments are going up. Say my mortgage payments go up $100 a week that means I have less money to spend on discretionary spending. Going back to our bed manufacturer, if I was planning on buying a bed this year, I might not be able to afford one now and will wait longer to replace my aging bed. Say 2,500 New Zealanders are in the same boat and are no longer going to buy a bed. This means that the demand for beds has dropped and therefore the manufacturer will realise they are not selling as many beds and prices will stabilise or go down.

The Reserve Banks blunt tool of increasing rates takes time to filter through to peoples back pocket. If I took a 5 year fixed rate in 2020 at 2.99% that means I am going to remain on that lower rate until 2025 so when the interest rates increase it has absolutely no affect on my buying power and I can keep spending like I always have and this fuels inflation. This means that inflation in theory will remain high for some time, as some people haven’t felt the effect of the recent increase in interest rates. Here in NZ though, the majority of people fix for shorter terms and the quicker we come off our low fixed rates the quicker we can control inflation.

For those of us on the ground it means we go out for dinner less, we travel less, and we generally spend less. It hurts and it can affect our quality of life. However, we as consumers can have a direct effect on inflation by spending less. If the demand goes down prices will likely follow or stop going up at the same rate. Imagine if we all collectively as a country decided next week to only shop at Pak & Save. What does that mean for Countdown? If Countdown have 100,000 less kiwis spending money in their supermarkets, then how would they respond? Would our cauliflower now cost $3?

Impacts on Home Loans:

As anyone who is applying for a home loan will know now, the goal posts are so much higher. We’ve had a change to lending regulation via the Credit Contracts and Consumer Finance Act (Or more commonly known as the CCCFA) this has meant that qualifying for a new home loan has become so much harder. On top of that the banks test rates have increased. Test rates are in blunt terms the rate at which the bank tests your ability to afford your loan now and if rates increase so does the test rate. Although the current market rate might be 5.45% the banks would test your ability to afford your debt if rates increased higher. As a general rule, the test rate would be 2.00% or more higher than the current market rate. So, if you were approved last year for a loan of $700,000 you may only be able to borrow $500,000 this year.

This has a direct effect on our buying power when it comes to homes and the flow on effect is that we have seen house prices drop as people don’t have the ability to borrow as much and therefore either their expectations change, or potential sellers have to lower their asking prices. This has resulted in a slump in home loan enquiries and approvals as banks try to mitigate the rise of borrower’s affordability and the potential of people being in a negative equity situation. (this means that your debt is higher than the value or your property) This particularly affects our first home buyers who may have purchased in the last 12-18 months. If you purchased with a lower deposit (less than 20% of the value of your home) then you are at risk of being in a negative equity position.

This has a direct effect on our buying power when it comes to homes and the flow on effect is that we have seen house prices drop as people don’t have the ability to borrow as much and therefore either their expectations change, or potential sellers have to lower their asking prices. This has resulted in a slump in home loan enquiries and approvals as banks try to mitigate the rise of borrower’s affordability and the potential of people being in a negative equity situation. (this means that your debt is higher than the value or your property) This particularly affects our first home buyers who may have purchased in the last 12-18 months. If you purchased with a lower deposit (less than 20% of the value of your home) then you are at risk of being in a negative equity position.

But don’t panic! If you are in a position where you are not planning to sell in the near future this won’t be a problem as long as house prices continue to go up over time. Also remember that over time your loan is going down as you continue to pay down the principal balance.

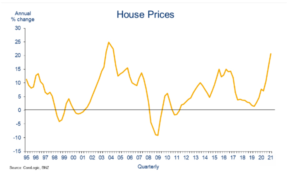

Below is a graph from Core Logic shows the annual change in house prices since 1995. As we can see we have had periods of decreasing house prices however over time the trend is upwards.

Source: Core Logic

What happens next?

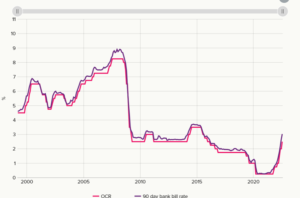

Before we go into this, I need to prequalify this by stating that I am not an economist, and we really don’t know what will happen in the future. So many factors effect what happens with rates going forward. In 2011 when everyone was expecting rates to rise then there was a major earthquake in Christchurch and almost immediately the Reserve Bank actually lowered rates to help stimulate the recovery. In 2020 we had the pandemic, and the result was the lowest OCR since it was introduced in 1999. Global or local situations can influence what happens with rates. At this stage though, the major banks in NZ, the Reserve Bank and a lot of economists are predicting rates to continue to rise. At this stage the predictions are that the OCR will increase to around 4.00% to 4.50% before plateauing. Below, from the Reserve Bank shows you what the OCR movements have been since being introduced in 1999.

Source: RBNZ

As we can see, since around the end of the Global Financial Crisis (GFC) the OCR has been around the 3% range, dropping in 2015. Is this the new normal or are we going to see rates go up even further? Given the rate of inflation you would assume that rates need to go even higher than what we have seen since 2009. So, unless there is a global or local catastrophic event the trend will likely continue.

In summary, Inflation is taking time for NZ and the world to get under control. We also have a war in Ukraine and climate change to consider. Once supply chain issues have been resolved, prices stabilise, and the world goes back to some sort of normal we will continue to see inflation affecting our interest rates.

In the meantime, we are all going to be paying more. More for fuel, more for food and more for goods and services. If there is a silver lining it is that house prices are finally going down and if you are saving hard for a deposit, hopefully you are in a position sooner rather than later to get into the market.

Thanks for reading and hopefully this has given you some insight into what inflation is, and how it affects our lives in 2022.

Glenn Colclough – Financial Adviser.